The DEBT snowballing method

Hello everyone, I hope you are doing well and growing in the Lord every day. I want to start a series of blogs specifically about personal finance. Throughout this course, I want to share the lessons that I have learned and things that I have implemented that have helped my journey in personal finance.

To give you a quick background, as far as I can remember, we always had issues with managing finances within our family and we always felt short on meeting our needs at the end of the month. I grew up seeing my parents struggle and it was not a good place to be in, so when I started earning, I made a promise to myself that I would not make the same mistakes that my parents did. Fast forward a few years, and I found myself dealing with the same issues that my parents did.

What went wrong for me? I used to think, "Well, I've never had lavish lifestyle or unnecessary expenditures , so how did things go down the drain for me?" The answer is that I made some poor decisions over time, and there came a point when I had to tell myself enough was enough and that I needed to work on my finances. While reviving my personal finances, I came across Dave Ramsey and read his book Total Money Makeover, which changed my outlook on personal finance. So, with this series, I'm hoping to shed some light on points that you can implement and allow yourself to have a plan to work on your personal finance if you're also struggling to maintain it.

The snowball method

So Today lets talk about Snowballing debt reduction method!

Debt is a form of slavery the sooner you can come out of it better for you, Bible says"The rich rules over the poor, and the borrower is the slave of the lender.”Proverbs 22:7. If you are currently struggling with debt and have no idea how to escape the never-ending cycle of debt, then this blog is for you.

The snowball method is a popular debt-reduction strategy where you pay off your debts from smallest to largest, gaining momentum as each balance gets paid off. It’s also known as "rolling down the hill," because it's like rolling a snowball down a hill: The bigger it gets, the faster it goes. Here’s how it works:

The snowball method is one of the most effective ways to pay off debt. It's also a very simple concept: pay off your smallest debt first, then the second smallest, and so on.

The benefit of this method is that it helps you see progress quickly, which in turn motivates you to keep going until all of your debts are gone. By paying off a smaller debt and feeling the weight lifted from your shoulders, it makes paying off larger debts seem like less of an impossibility—and thankfully, it really isn't.

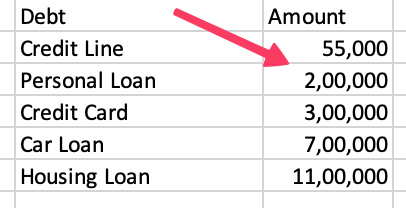

To do the snowball method, you’ll need to organize your debts from smallest to largest by amount.

To do the snowball method, you’ll need to organize your debts from smallest to largest by amount. It’s easiest to track them on paper or in a spreadsheet.

Then, begin paying off whichever debt is smallest first. While you may be tempted to pay off the one with the highest interest rate first, that can often cause people to give up if they experience setbacks or face other financial challenges.

To stick with it, focus on one debt at a time and pay it off as quickly as possible — even if it means skipping a few meals out with friends or forgoing that new iPhone upgrade. Paying off one debt will make you feel like you’ve accomplished something significant and help motivate you to keep going until all of your debts are paid off!

This method can be effective because it allows you to see progress right away — which can be motivating! It’s also useful if you have multiple debts because it helps you decide which ones should be prioritized according

Before you start paying down the small debt, make sure you’ve got enough money left over after covering your essentials to pay at least the minimums on your other loans.

It's important to make sure you have enough money left over after covering your essentials to pay at least the minimums on your other loans. Otherwise, you'll just get into more debt! .

If you're just starting out with your finances, it can be hard to know where to begin. Start by tracking all of your financial transactions and planning ahead for what you want to do with your money. A budgeting app can help you plan better, but it's important to learn how to manage money on your own before relying too heavily on technology, Ideally simple spread sheet should work for most of us.

Before you start paying down the small debt, make sure you've got enough money left over after covering your essentials to pay at least the minimums on your other loans. If not, try cutting back on spending so there's enough left over or ask for help from friends or family until your small debts are gone and then go back to paying off bigger ones.

Once you’ve paid off your first loan, move up to the next loan on the list, and pay that one off using whatever amount you were paying each month toward the first one.

Once you’ve paid off your first loan, move up to the next loan on the list, and pay that one off using whatever amount you were paying each month toward the first one.

In this strategy you pay off your debts from smallest to largest. And instantly you can see results and feel good about your progress because every single payment reduces at least one of your loans. Plus, it's easy to use this method for multiple types of debt so long as they're all in one place (e.g., credit cards or student loans). An added bonus with this method is that it works well if you have more than one type of debt: once you've paid off all those small ones, you'll start seeing some bigger numbers going down!

Snowballing is a great way to stay motivated as you can see results quickly.

Another reason to use the snowballing method is that it is a great way to stay motivated as you can see results quickly.

If you're struggling to get out of debt, this will help keep your focus on what's important: getting out of debt!

It's also a proven method that has helped many people achieve their financial goals.

The snowball method can help you feel like you're making progress on your debt repayment, which can help keep you motivated to continue paying down your debts

Conclusion

By following the snowball method, you can quickly get out of debt and feel like a winner. You’ll be able to look at your finances with a sense of accomplishment and take control over your financial future

As I conclude I want to declare this verse over your life from Roman 13:8 Let no debt remain outstanding, except the continuing debt to love one another, for whoever loves others has fulfilled the law.

I pray that reading this blog has been a source of blessing for you, and if you have any questions, feel free to get in touch with me at jo@jogonsalves.com

God Bless you!